Digital Therapeutics and Pharma: How Novartis, Sanofi et al. Embrace DTx

Practically every major pharma company is getting involved in digital therapeutics, whether standalone or ‘around-the-pill’. We look at the different approaches the big players are taking and why DTx platforms help pharma leverage their assets in the market

- Almost any pharma company is exploring digital therapeutics these days, with the most recent announcements coming from Eisie and Teijin Pharma

- The likes of Sanofi, Bayer, and Boehringer Ingelheim are adopting a variety of strategies; some focus on around-the-pill, others bet on standalone, some partner big while others want to control strategic assets

- Building on DTx platforms is emerging as a best practice for cutting time-to-market through access to digital, regulatory, and medical device know-how

As more countries around the world enact legislative and regulatory measures that allow digital therapeutics (DTx) to reach more patients and enable reimbursement, pharma companies are hedging their bets. While it seems that some primarily want to put a toe into the water and thereby ensure they are not left at a competitive disadvantage later down the line, others see the opportunity to support their billion-dollar core business – or to create a new business altogether. We've taken a look at pharma's recent activity in the DTx space. Read on to find out how are the major players approaching this new sector.

A Lot of DTx: Recent Announcements

An ever-growing list of pharma companies are forming partnerships with technology companies developing digital therapeutics. Recently, Japanese pharma company Eisai announced a partnership with Voluntis, which will see DTx support cancer patients built upon Voluntis’ Theraxium platform. Teijin Pharma, meanwhile, has partnered with technology first Jolly Good to develop virtual reality (VR) DTx for major depressive disorder.

Major names such as Sanofi, Novartis, and Bayer have all formed high-profile partnerships in recent years, with the latter also driving investment in One Drop, who strive to develop digital therapeutics for people living with diabetes, pre-diabetes, high blood pressure, and high cholesterol.

Those examples alone demonstrate the scope of digital therapeutics when it comes to the diseases they can help treat and the methods they employ. Furthermore, they demonstrate how DTx can operate as standalone treatment options (such as Jolly Good’s VR DTx) or work alongside regular therapeutics to improve outcomes (such as Voluntis’ DTx platform).

Different Companies, Different Strategies

While the majority of pharma companies are investing in digital therapeutics, there are various different strategies at play. One of the key differences, as mentioned above, is standalone versus ‘around-the-pill’ DTx, which feeds into the bigger question of the most promising go-to-market strategy: 'Around-the-pill' DTx lend themselves to combination products that create an additional edge for a drug in a competitive marketplace while leveraging existing distribution and market access. On the other end, standalone DTx have the potential of creating entirely new businesses, but come with more uncertainty regarding reimbursement and may be less suitable for distribution through pharma's sales force.

Sanofi is one of the major pharma companies investing heavily in DTx. In an interview with McKinsey, Sanofi’s head of digital therapeutics, Bozidar Jovicec, highlighted how lifestyle factors such as diet and exercise account for 20 to 30 percent of a person’s health and the huge impact behavior change can have on health outcomes. In discussing Sanofi’s partnership with Happify, an app that can reduce anxiety and depression, he explained how the service can work in combination with MS drugs to help provide treatment that better meets patients’ needs, including those relating to mental wellbeing. This ‘around-the-pill’ approach is an example of a DTx that does not replace a regular drug but works alongside it and helps patients in a way the drug cannot. Furthermore, he pointed out that Sanofi aims to provide the service to anyone living with MS, not just those prescribed Sanofi’s MS drugs, demonstrating how the partnership can provide commercial benefits beyond supporting their own products.

Bayer’s investment in One Drop, meanwhile, represents an approach of digital therapeutics forming a part of integrated care. OneDrop claims that in many cases, the platform’s healthcare plan and management tools can reduce, prevent, or delay the need for typical diabetes drugs, particularly for people living with prediabetes. Thus, Bayer’s involvement is not necessarily an attempt to improve the efficacy of its medications; rather, it is a sign that the industry recognizes the importance of outcome-driven solutions. The financial might of big pharma and its access to payers, combined with the agile and innovative approach of tech companies helps expedite development effort and, ultimately, can provide significant commercial benefits to both parties.

Pharma’s expertise in clinical development and global commercialization was also a driving factor behind Boehringer Ingelheim’s partnership with Click Therapeutics, whose DTx platform helps support and treat people living with schizophrenia. Click Therapeutics historically developed stand-alone DTx. The collaboration with Boehringer Ingelheim, however, appears to coincide with the go-to-market of a new schizophrenia drug of the German pharma giant, so there is reason to believe that commercialization may happen through a combination product.

By clinching exclusive global rights to the treatment, Boehringer Ingelheim became a leading player in innovative treatment for neuropsychiatric disorders. In return, Click benefits from the clinical, regulatory, and commercial know-how of a major player.

And while Novartis’ rocky partnership with Pear Therapeutics has left question marks over their digital therapeutics strategy, the company’s acquisition of Amblyotech – which is developing a digital treatment for “lazy eye” – shows a commitment to the DTx market. Indeed, Jeremy Sohn, VP, Head of Digital Business Development & Licensing at Novartis, has publicly reiterated that the company will continue to invest in digital therapeutics that demonstrate positive outcomes, whether standalone or around-the-pill.

Novartis’ acquisition of Amblyotech also shows how the company is seeking a level of control beyond simply partnering. One of the reasons touted for the partnership with Pear Therapeutics ending prematurely was an apparent divergence over long-term strategic goals and owning the customer relationship, which may be a factor in the decision to pursue an outright purchase. In contrast, Bayer’s partnership with One Drop, for example, includes further investment dependent on the DTx company achieving development commitments and commercial milestones. Beyond the different approaches to the therapeutic applications of digital therapeutics, these deals go to show how pharma is also taking different strategic approaches to DTx.

Why Everybody in Pharma is betting big on DTx Platforms

While there has always been some debate as to whether pharma needs to be involved in digital therapeutics at all, the level of investment from pharma companies suggests they are in it for the long haul. However, the DTx landscape is far from the maturity of pharma’s core business, where it is well understood how to commercialize molecules that have been developed in-house, through licensing, or by means of M&A. And while DTx strategies differ, it seems like the use of DTx platforms is emerging as best practice for cutting time-to-market through access to digital, regulatory, and medical device know-how.

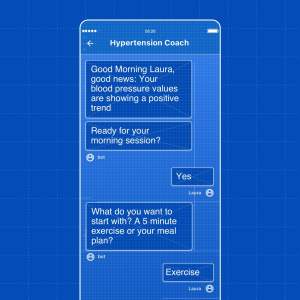

Many digital therapeutics require a foundation containing the same underlying attributes, such as proven user acceptance, engagement, and retention. By using a platform that can deliver those attributes out of the box, resources and development efforts can be spent on innovative and specialized features and the specific regulatory pathway.

While most platforms are increasingly ticking the regulatory boxes, the MyTherapy platform also stands out when it comes to user acceptance – with millions of users already actively using it, typically as often as six times a day – a substantial asset for any DTx, where engagement typically is a pre-requisite for real-world efficacy. Sounds interesting? Please don’t hesitate to reach out. By building your DTx on MyTherapy, your patients will benefit from regulatory compliance under MDR and FDA and from every new feature and update we release.